24 Tax Write-Offs for Freelance Writers in 2025

When writing for work, you’ll most likely be paying for expensive but helpful online writing tools like Grammarly or Hemingway. Thankfully, they are considered write-offs as they’re used for business purposes. What’s even better is that we also found other write-offs for freelance writers that you can claim on your taxes!

General Expenses

Let us help you.

Working From Home

Having a dedicated office space for business purposes, like writing or having meetings with clients, is very beneficial. If you have a small office or desk used exclusively for work, here are some tax write-offs.

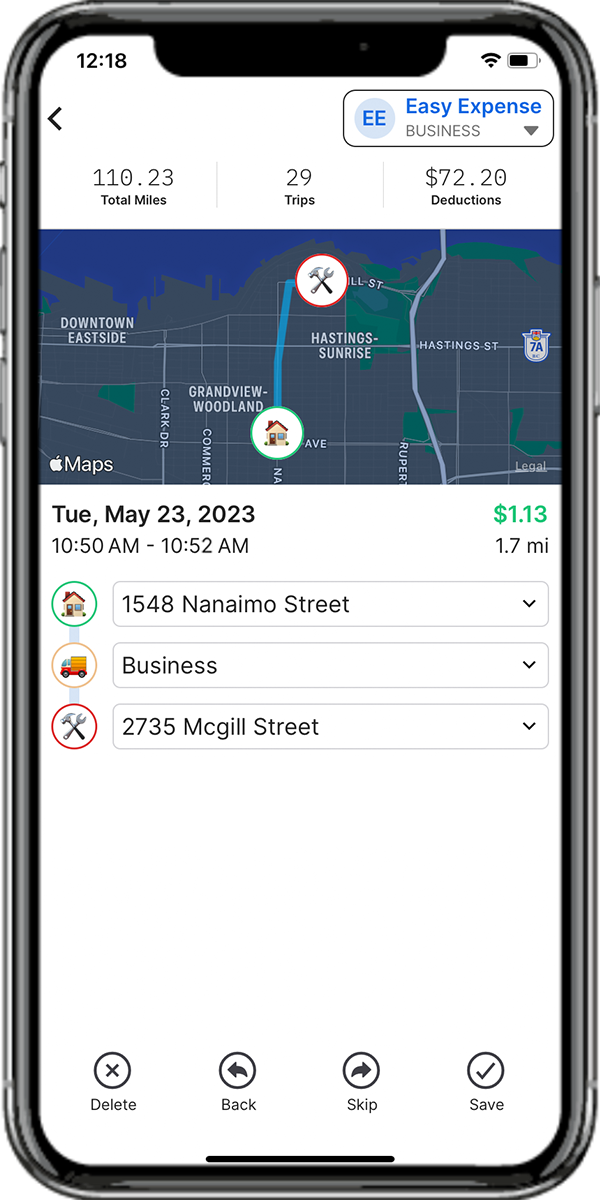

Driving For Work

If you’re meeting with clients to discuss business matters like upcoming projects, track these actual car expenses to maximize your tax deductions!

Traveling For Work

Sometimes you’ll be traveling out of town as a freelance writer for business purposes. Events where you can improve your writing skills or meet with potential clients, come with certain write-offs.