25 Tax Write-Offs for House Sitters in 2025

Although house sitting isn’t discussed as much as other jobs, it can still be a good source of income. There’s always someone going on vacation and will need their house watched. This will usually include their pets and plants. As a self-employed or independent house sitter, here are some common house-sitting expenses to help you maximize your tax write-offs!

General Expenses

Let us help you.

Working From Home

Advertising your business or looking for contract work should be done in a dedicated office space. That way, you can track these home office expenses when operating your business from home. It doesn’t have to be a dedicated room–even a small desk works!

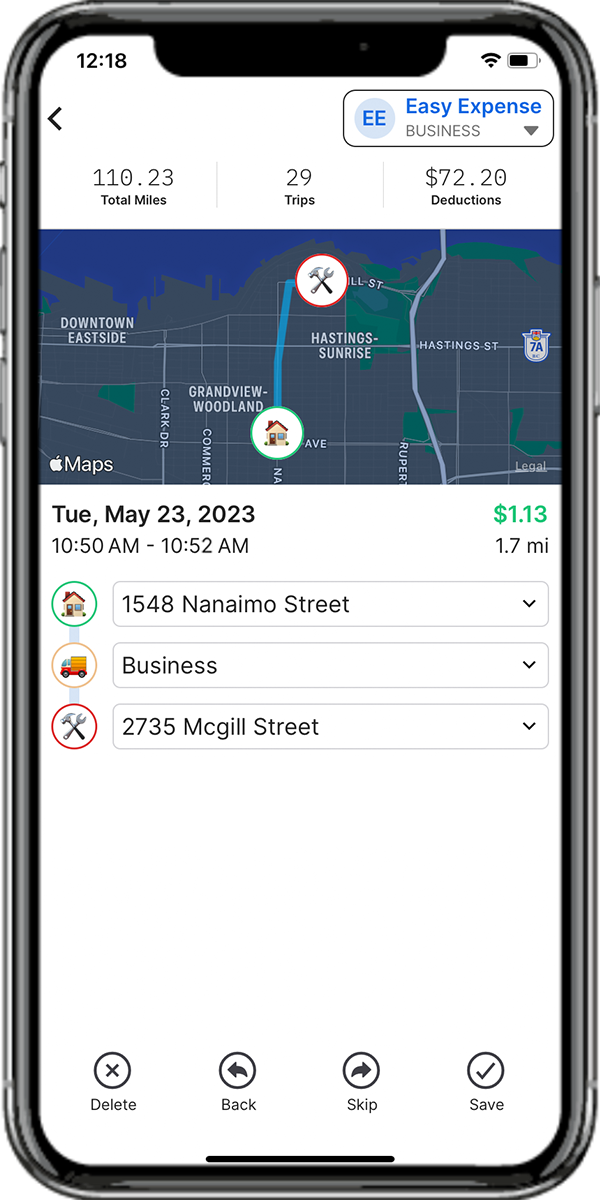

Driving For Work

You’ll often be driving from client to client or visiting a client’s house for business. Track these actual car expenses if you don’t plan to use the standard mileage deduction.

Traveling For Work

If you’re meeting other house sitters or clients to discuss business, those meals are tax deductible. There are also a few tax write-offs when traveling away from home for business purposes. For example, house-sitting for someone outside your city requires you to stay at a hotel when you’re not watching the house. So for those hotel and transportation costs, write it off!