26 Tax Write-Offs for Plumbers in 2025

As an independent or self-employed plumber, expenses can pile up quickly when purchasing plumbing materials and tools. Avoid paying thousands of dollars on your taxes by tracking these common expenses for plumbers.

General Expenses

Let us help you.

Working From Home

Running a plumbing business from your home can have quite a few expenses. If you have a dedicated space used only for business purposes like administrative or management activities, track these home office expenses! It can be a little room or even a desk in the corner works!

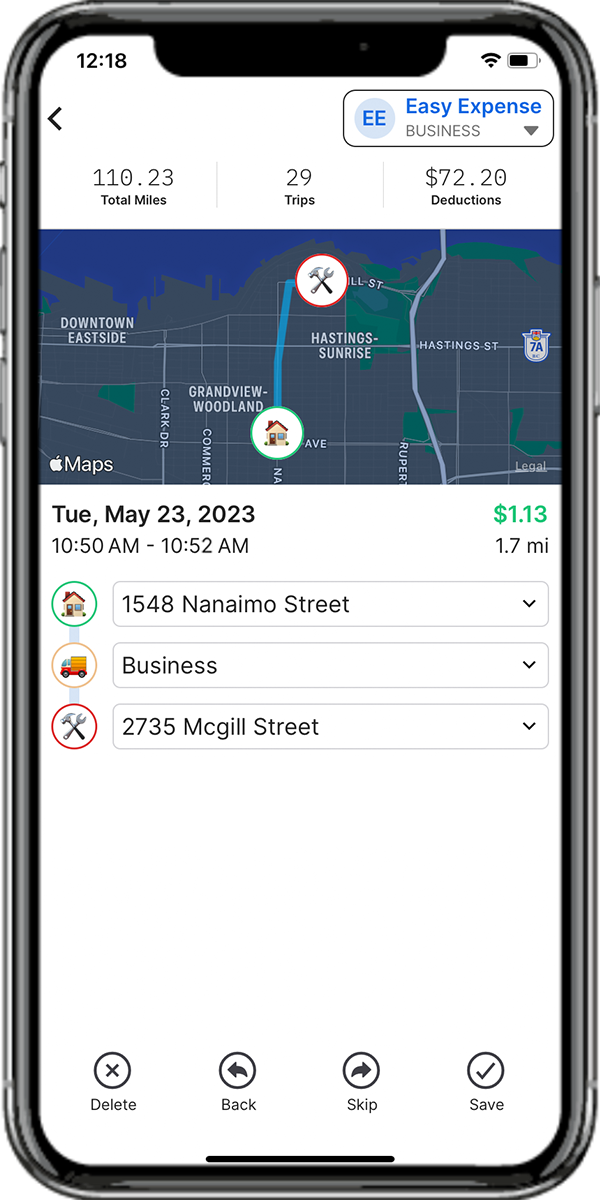

Driving For Work

You’re most likely driving from client to client or a worksite as an independent plumber. With the cost of gas rising, it’s important to claim mileage deductions to offset the costs. Here are some expenses you can track if you want to use the actual car expense deduction instead of the standard mileage deduction.

Traveling For Work

Sometimes plumbing projects require you to travel out of town where places to rest, such as hotels or Airbnb rentals, become necessary. Track these business travel expenses when traveling away from home for work!