24 Tax Write-Offs for Virtual Assistants in 2025

As a virtual assistant, completing tasks for your client will most likely require software subscriptions, amongst other things. Due to the independent nature of the job, paying out-of-pocket for these expenses is common. Track these common expenses so that you can save more money on your taxes!

General Expenses

Let us help you.

Working From Home

Since being a virtual assistant requires you to work remotely, you'll most likely have a dedicated office space to conduct work. Whether it's a desk or a dedicated corner in your room, there are tax deductions for it if used for work.

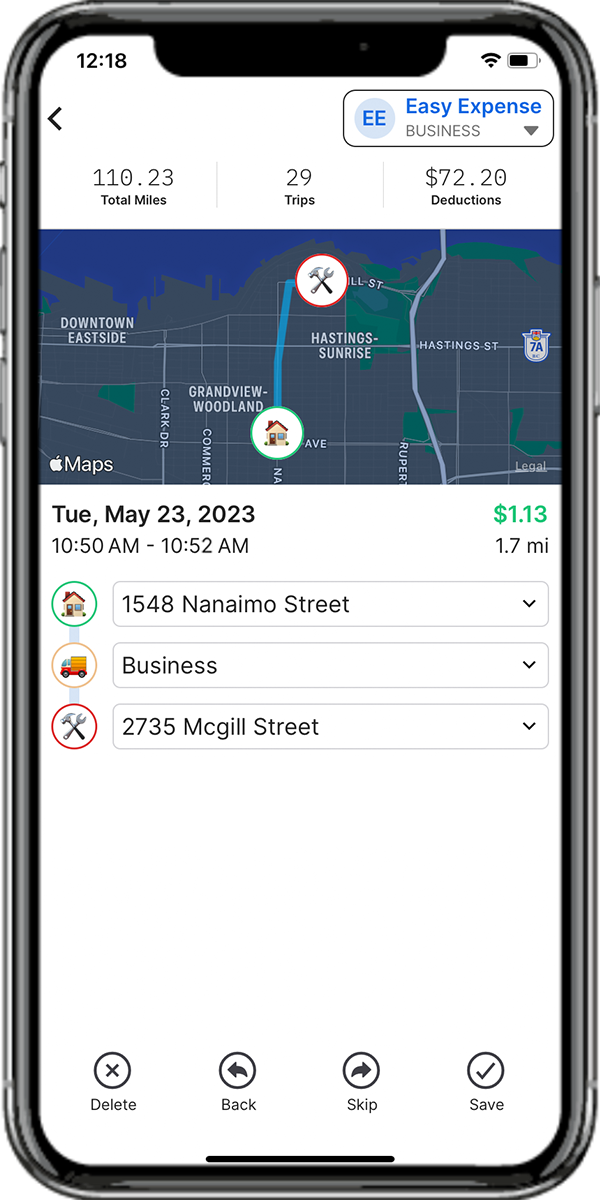

Driving For Work

Although uncommon, virtual assistants may drive to certain places for their clients. Be sure to track these car expenses when driving for business purposes!

Traveling For Work

Traveling away from home may be required, especially when there's a client-related event. Thankfully, there are tax deductions that you can track to maximize your deductions.