26 Tax Write-Offs for Landscapers in 2025

As an independent or self-employed landscaper, expenses can pile up quickly when it comes to landscape maintenance. Luckily, you can claim these as tax write-offs as long as you track the expenses. We’ve found some tax write-offs for landscapers to help you maximize your tax deductions.

General Expenses

Let us help you.

Working From Home

Running your own business or looking for landscaping jobs from home? As long as you have a dedicated space only for business, there are tax write-offs available. Whether you’re operating your business from a closet or a small desk, you can track these home office expenses.

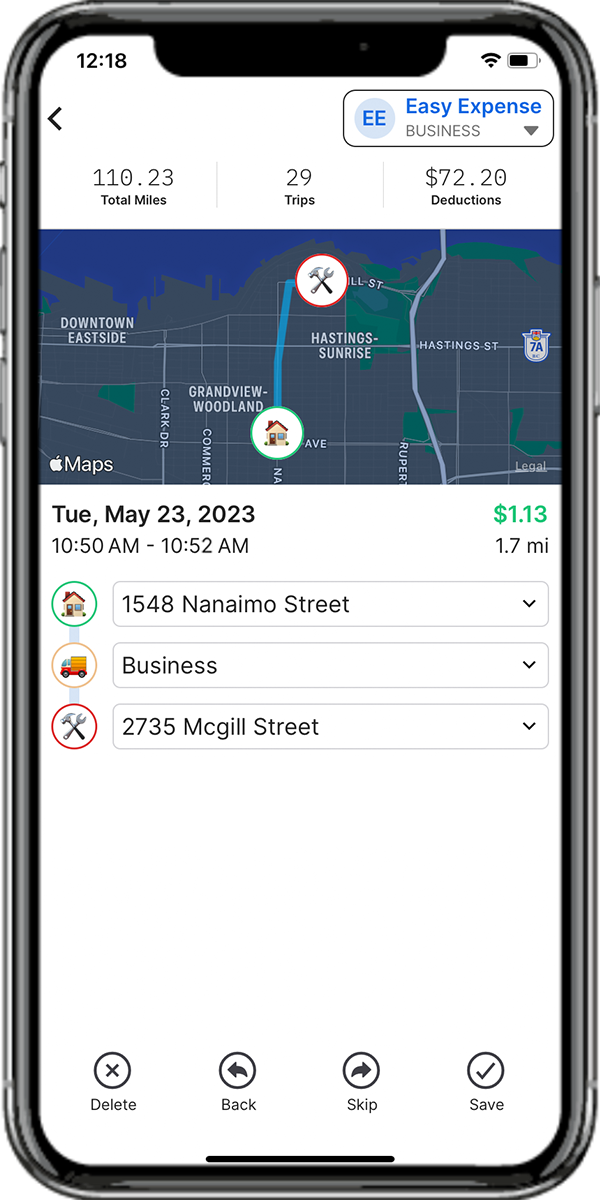

Driving For Work

Since you’ll most likely be working for yourself or as a contract worker, it’s common for you to drive from client to client. Track these actual car expenses as you complete your landscaping jobs or drive for business purposes. Then when filing taxes, find out if you’ll save more on taxes through the actual car expense deduction or standard mileage deduction.

Traveling For Work

Attending an event to improve your landscaping career? Or land a contract that requires you to travel far away from home? When traveling out of town for business purposes, track these tax-write offs!