25 Tax Write-Offs for Content Creators in 2025

Creating content for your client or yourself can be stressful. What’s even more stressful is the number of expenses required to keep making the content. Thankfully, we’ve found some tax deductions you can claim when filing taxes as a content creator!

General Expenses

Let us help you.

Working From Home

Creating content for your client or yourself can be stressful. What’s even more stressful is the number of expenses required to keep making the content. Thankfully, we’ve found some tax deductions you can claim when filing taxes as a content creator!

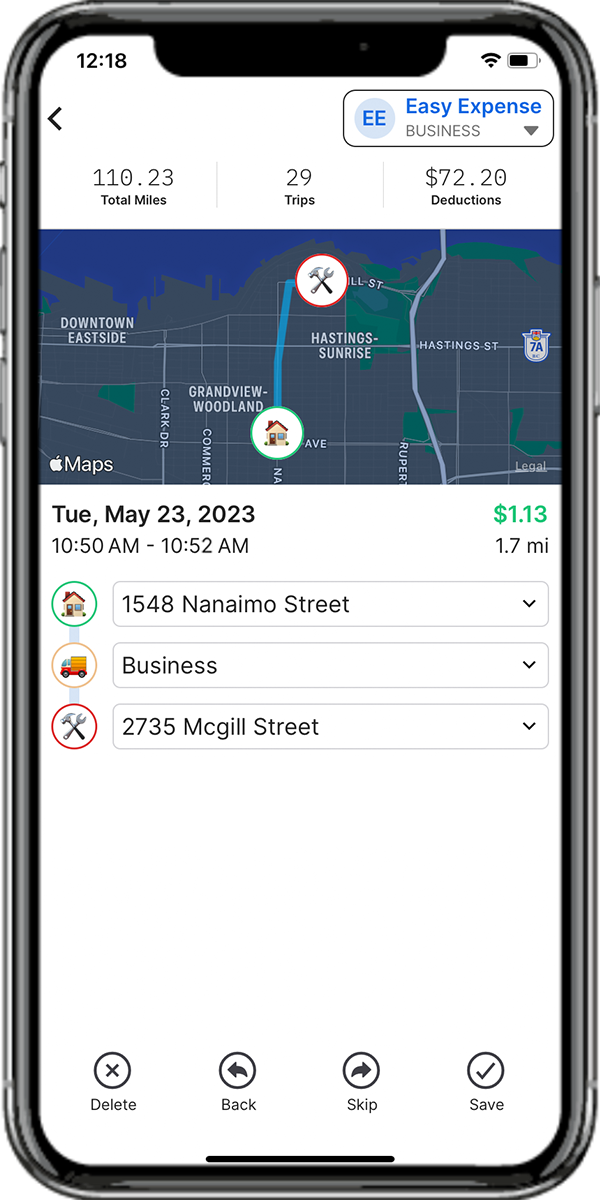

Driving For Work

If you’re driving to discuss business with clients or for a better recording location, track these car expenses if you plan on using the actual car expense deduction.

Traveling For Work

There are claimable tax deductions when traveling far away from home for business purposes. For example, your client might need you to travel to Japan to create content. Expenses from hotels and traveling related to your business trip can be written off.