26 Tax Write-Offs for Small Business Owners in 2025

Being a small business owner is no easy task. The costs quickly rise as you buy more things to keep your business running smoothly and being self-employed equals higher taxes. One way to reduce the impact of these costs is with small business tax write-offs. Tracking certain business deductibles lets you claim small business tax deductions to reduce your taxes. Thankfully, we’ve compiled a list of small business expenses so you can start tracking to pay less taxes!

General Expenses

Let us help you.

Working From Home

As a small business owner, you’ll want to expand your reach using the internet for more potential business. This may include online advertising, marketing research, and even posting on social media. Having a space in your home used only for business activities like above (e.g., a small desk), allows you to track these home office expenses.

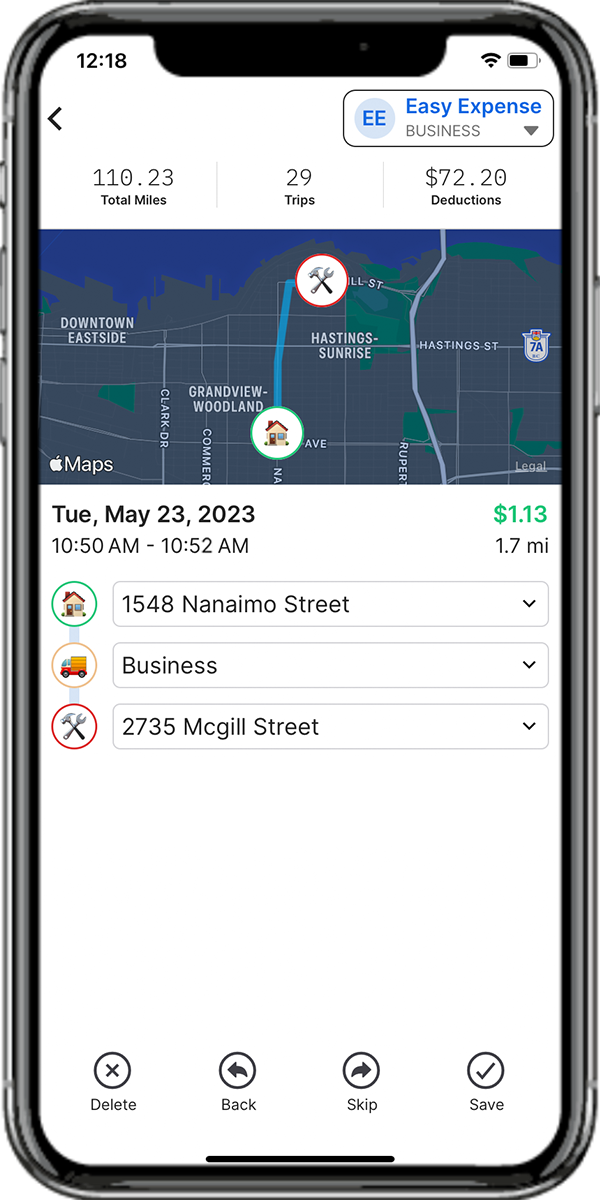

Driving For Work

Depending on what kind of small business you are, you may find yourself driving often. If you’re driving for work or business purposes, you’re allowed to claim mileage deductions or car expense deductions. As you can’t claim both types of deductions, track these car expenses to help you decide which to claim.

Traveling For Work

Generally, there are certain travel expenses you can deduct when traveling out of state or somewhere that requires you to stay at a hotel or Airbnb. Examples of traveling far away may include events such as business conferences, skill workshops, or a work contract.