12 Tax Write-Offs for Uber and Lyft Drivers in 2023

Want to maximize your tax write-offs?

Simplify your bookkeeping and maximize your tax returns with Easy Expense.

If you’re a rideshare driver for services like Uber or Lyft, you’re considered an independent contractor. As such, you’re responsible for paying your taxes since they aren’t withheld from you. However, you can save money on your taxes by maximizing your tax deductions with these ride-sharing tax-write offs!

General Expenses

Membership & Service Fees

Fees related to an organization or service used to find or conduct business are tax deductible.

Phone & Service

If you use your phone for work, the purchase and monthly bill are tax deductible.

Phone Accessories

Accessories for your work phone, such as USB charging cables, are tax deductible.

Snacks & Refreshments

Providing snacks and refreshments for your passengers is tax deductible.

Software Subscriptions

Monthly or annual subscription fees for computer software or apps related to your job or business are tax deductible.

Tools & Equipment

Standard business equipment and tools used for work are tax deductible.

Sick and tired of tracking expenses manually?

Let us help you.

Let us help you.

💵 Get $14,277 in tax write-offs on average

⏳ Save time with automated bookkeeping

😊 Simplify taxes and reimbursements with our reports

What are you waiting for? Start tracking today!

Driving For Work

Since you're driving for work, you'll have to decide whether you want to take the standard mileage deduction or the actual car expense deduction. Regardless, track the car expenses below to help maximize your deductions!

Gas

Gas for your business vehicle is tax deductible.

Parking & Tolls

Business-related parking and toll fees are both tax-deductible expenses. However, parking fees paid to park at your workplace are not deductible.

License & Registration Fees

License and registration fees required to drive your business vehicle are tax deductible.

Roadside Assistance

Roadside assistance expenses are tax deductible. If you have a roadside assistance plan, it’s tax-deductible if your insurance plan doesn’t include it.

Vehicle Insurance

The insurance cost for your business vehicle is tax deductible.

Vehicle Maintenance

Repairs and costs to maintain your business vehicle are tax deductible.

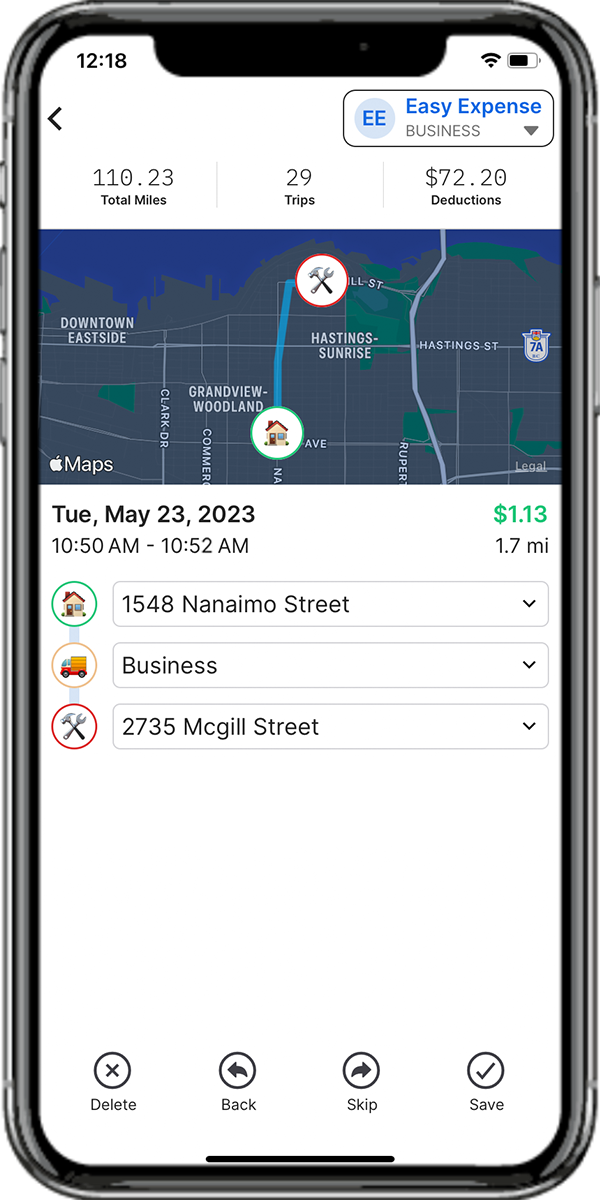

Automate Your Mileage Tracking

💵 Get $6,000 in tax deductions for every 10,000 miles

⏳ Save time and review trips in seconds with GPS tracking

😊 Easily claim deductions with our simple reports

Start tracking with Easy Expense today, so you can focus on what matters most!