23 Tax Write-Offs for Tutors in 2023

Ever wondered if becoming a tutor was a viable career? The U.S. Bureau of Labor Statistics (BLS) says tutoring jobs should grow by 14%. What's even better is that self-employed tutors will be half of that growth rate! So if you decide to become a tutor, consider being self-employed or an independent contractor.

As a self-employed tutor, that means you'll need to buy equipment and materials. Unfortunately, you’ll be paying out-of-pocket as you won’t have an employer to reimburse you. Since these are necessary and ordinary purchases for tutoring, they are tax write-offs. In other words, they’re tax deductions that you can claim when filing taxes. To help you, we've compiled some of the common expenses for self-employed tutors!

General Expenses

Let us help you.

Working From Home

If you’re an online tutor or run your tutoring business from home, you’ll want a dedicated business space to track these home office expenses. It doesn’t have to be a large room—even a small desk works!

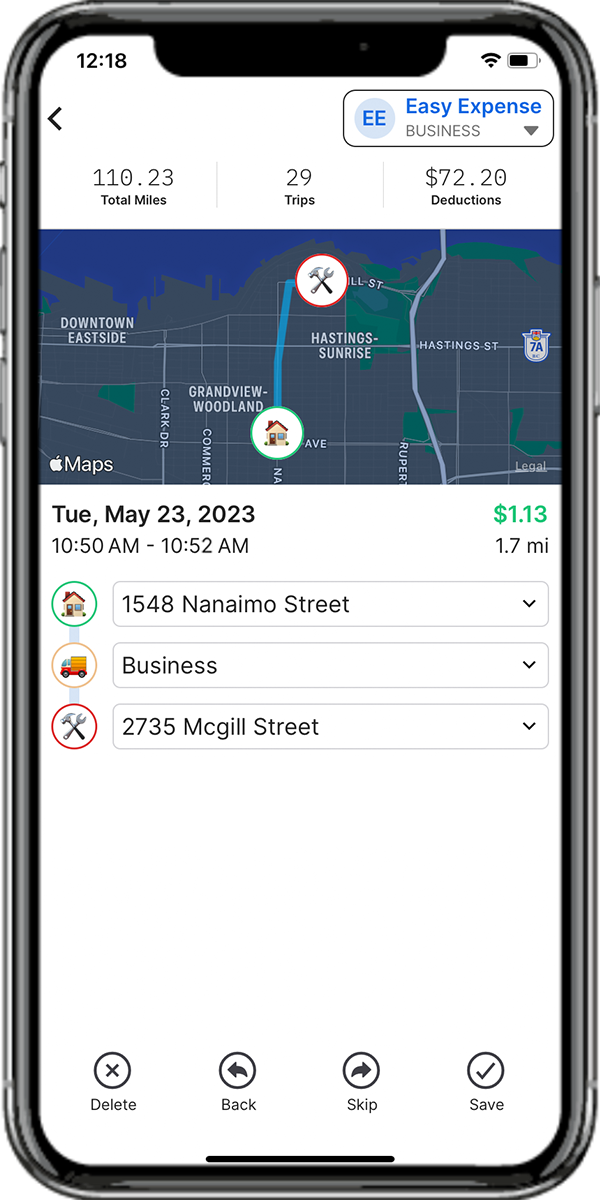

Driving For Work

As a home tutor, you may see yourself driving from client to client, or driving to your client’s house. Since you’re driving for business purposes, track these actual car expenses if you don’t plan to use the standard mileage deduction.

Traveling For Work

Sometimes there may be events that require you to travel away from home, such as a workshop to improve your teaching methods. Here are some tax write-offs when traveling out of town for business purposes.