25 Tax Write-Offs for Streamers in 2023

If you’re streaming on platforms like Twitch with the intent of making money, you can claim business tax deductions if you’re a self-employed streamer! With the streamer tax write-offs that we’ve found for you, you can reduce the amount of taxes owed. For example, buying custom emotes or streaming equipment (e.g., webcam, microphone, monitors, etc.) to improve the streaming experience for your viewers is tax deductible.

General Expenses

Let us help you.

Working From Home

Unless you’re strictly an in-real-life (IRL) streamer, you’ll probably be streaming from your home and therefore, working from home. If you have a space for only business and streaming-related things, you can can track these home office expenses.

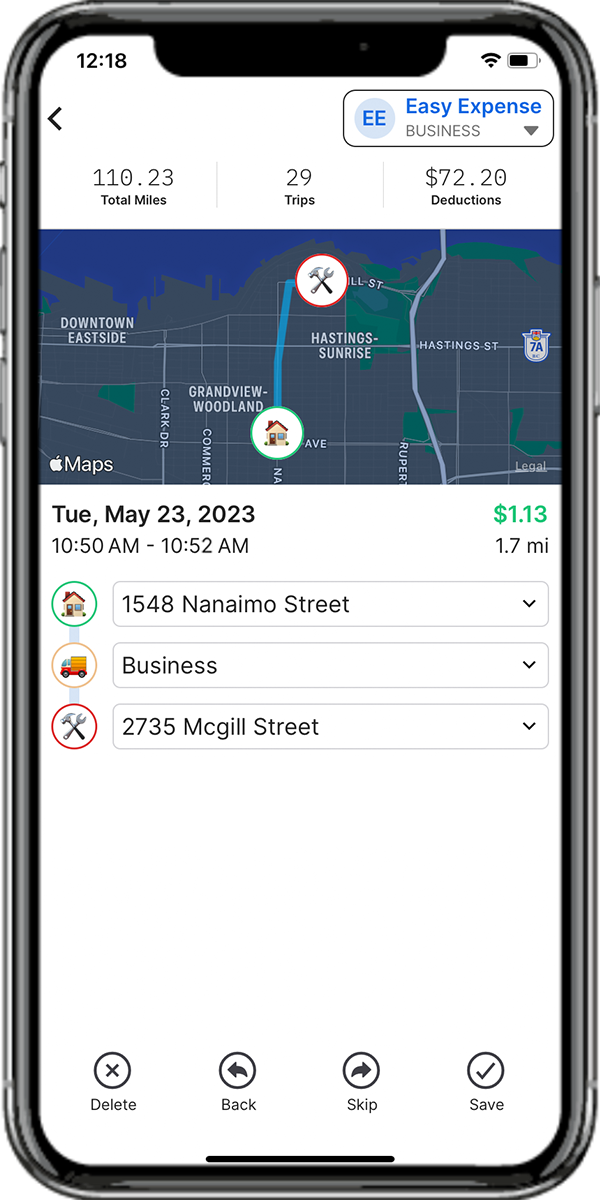

Driving For Work

If you’re driving for business purposes like meeting a client to discuss a potential collaboration or streaming at a certain location, track these car expenses!

Traveling For Work

Going out-of-state for TwitchCon or another streaming event that requires you to stay at a hotel or Airbnb? You’ll be glad to know that you can write off the travel expenses since you are traveling for business-related purposes, like expanding your streaming network or meeting potential sponsors.