24 Tax Write-Offs for Real Estate Agents in 2023

As a self-employed or independent real estate agent, getting to make your own schedule and picking the clients you want to work with is a dream come true. However, running your own real estate agency means owning all the costs. Knowing what tax write-offs you can claim helps reduce the amount of taxes owed. We’ve compiled a list of deductible expenses to save you time and money.

General Expenses

Let us help you.

Working From Home

Unless you’re listing houses through your phone, you’ll most likely be working from home on your computer. Along with the flexibility, working from home also means you can claim certain tax deductions. If you have a dedicated office space for business, you should track these home office expenses.

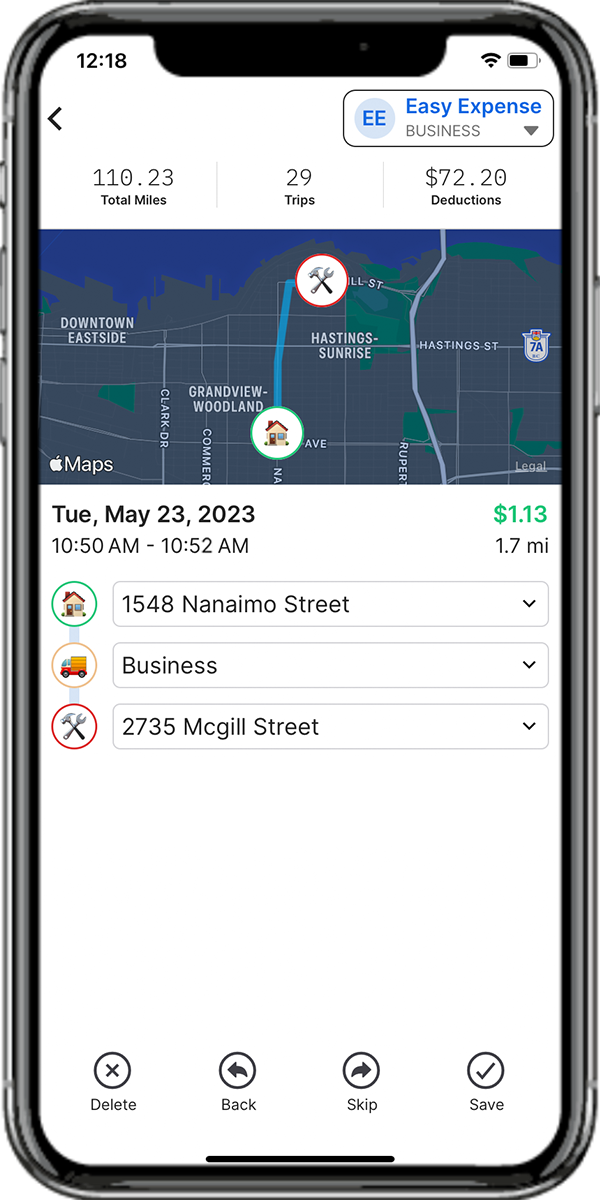

Driving For Work

Being an independent real estate agent means you’ll be driving for business often. The number of miles driven will quickly rise as you travel to different properties for inspections, viewings, or client meetings. Track these car expenses so you can compare them with your standard mileage deductions.

Traveling For Work

If you’ve expanded to a point where you’re flying away from home for business, you can claim these business travel deductions. For example, you can write off hotel and flight expenses if you’re doing a property viewing out of state. Other business purposes such as workshops or conferences will also work.