24 Tax Write-Offs for Freelance Photographers in 2023

As a freelance photographer, it can be costly to run your self-employed business. Business expenses can quickly increase due to camera equipment, editing software, travel costs, etc. Thankfully, many of these expenses are tax write-offs, which reduce your taxable income to save you more money. Check out these common tax deductions for freelance photographers below!

General Expenses

Let us help you.

Working From Home

Editing photos, connecting with clients, or advertising your business online usually means you’ll be working from home due to the nature of freelance photography. However, if you have a dedicated space for business (a desk is fine), here are some tax write-offs you can claim.

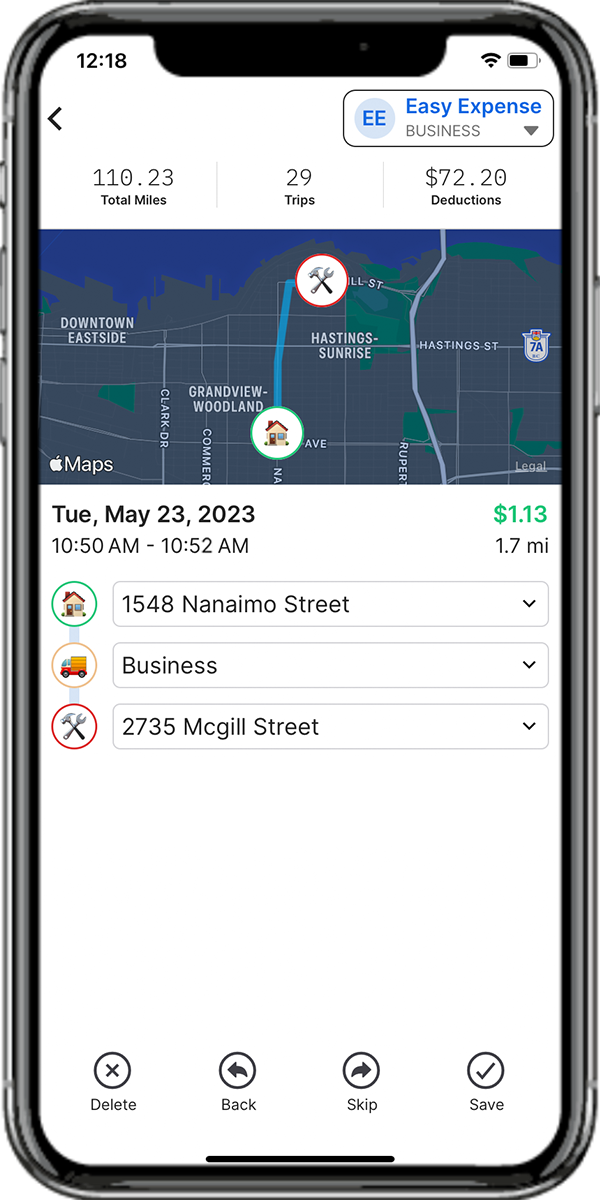

Driving For Work

Rather than clients coming to you for shoots, it’s normal to find yourself driving from one photo shoot location to another. Since you’re a self-employed photographer, there are deductions you can claim due to the costs of driving.

Traveling For Work

There are times when you’ll be going out of state for business purposes. For example, a client has a wedding in a different state and wants you to take photos there. Or there’s a freelance photographer workshop that you must fly across the country to attend. As such, there are business travel deductions you can claim since you’ll likely be staying at an Air BnB or hotel.