23 Tax Write-Offs for Personal Trainers in 2023

As a self-employed or independent personal trainer, you’ll be helping others achieve their physical fitness goals to improve their overall well-being. Doing such things comes at a cost, and it’s usually out of your pocket. However, we’ve found some personal trainer tax write-offs that you can use to reduce the impact of those costs!

General Expenses

Let us help you.

Working From Home

Being a personal trainer doesn’t mean you’ll always be at a gym or fitness facility. There are often times when you’ll be working from home doing things such as online sessions, scheduling, or industry-related research. If you have a space in your home dedicated to business, here are some home office expenses you can track!

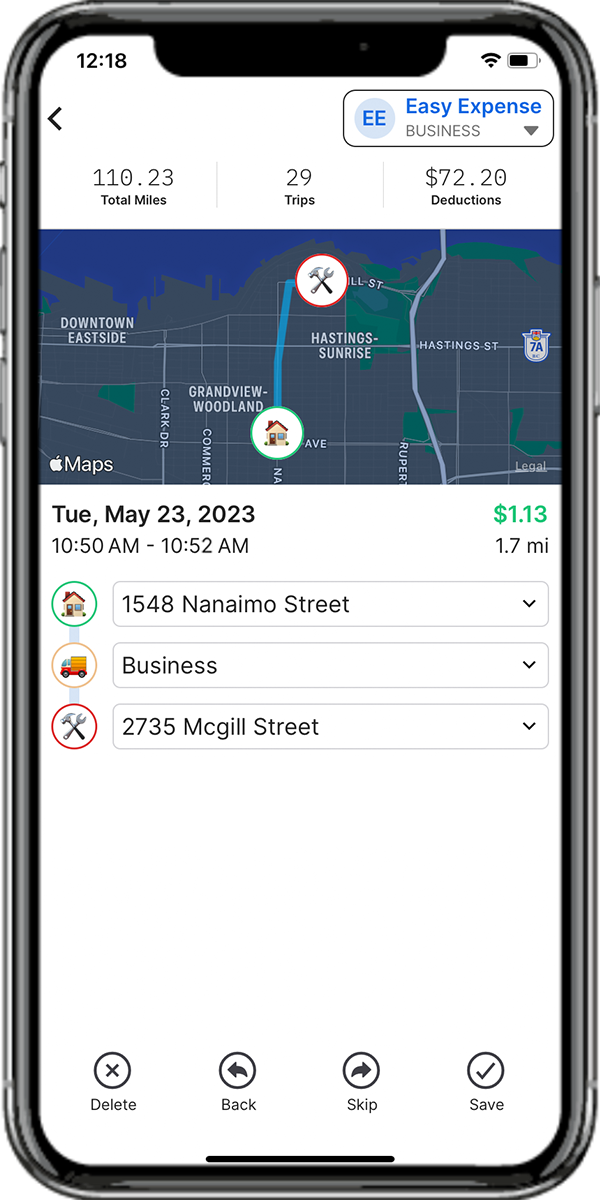

Driving For Work

If you provide in-home training or travel to different locations to train clients, you’ll be driving for business-related purposes which is tax deductible. Although it’s fine to use the standard mileage deduction, tracking these car expenses may help you save even more with the car expense deduction.

Traveling For Work

Are you attending a personal trainer workshop, or training a client that requires you to travel far away from home? Generally, there are tax expenses you can deduct if you have to stay at places like a hotel or Airbnb.