24 Tax Write-Offs for Freelance Makeup Artists in 2023

Being a freelance makeup artist means you’ll be using tools like brushes or sponges to improve or change a person’s look. Unfortunately, you can use a brush to change certain things but you can’t brush away the business expenses. As a self-employed makeup artist, there are certain freelance makeup artist tax write-offs that you can claim to save more on your taxes!

General Expenses

Let us help you.

Working From Home

If you have a dedicated space in your home for business, you can track these home office expenses. Business purposes can include doing a client’s makeup, online advertising, or scheduling makeup appointments.

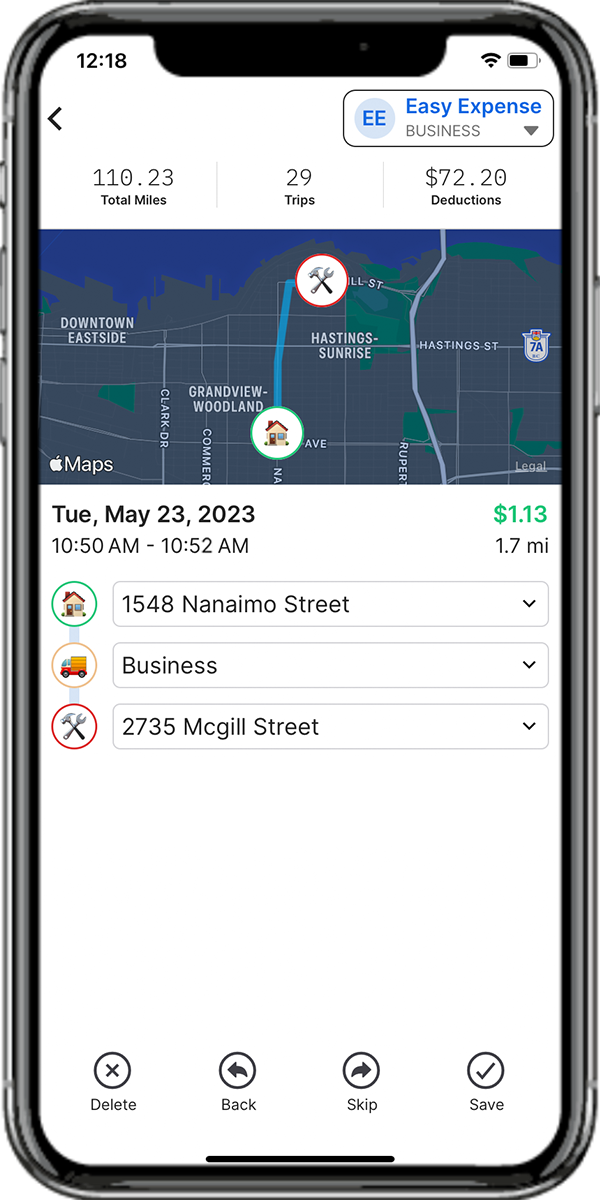

Driving For Work

Oftentimes you’ll be driving to a client’s location or a facility for work, allowing you to claim driving-related deductions. Track these car expenses to see if you’ll save more with the car expense deduction or the standard mileage deduction.

Traveling For Work

Imagine a client who wants you to travel out of state to do their makeup for a few days. However, they aren’t reimbursing you for travel fees, so you’ll have to pay it out of pocket. Thankfully, you can claim the travel expenses such as hotel and transportation fees as business tax deductions.