23 Tax Write-Offs for Consultants in 2023

As an independent consultant, you're most likely a freelancer doing gig work or working as an independent contractor. Unfortunately, running your own consulting business means paying out of pocket for expenses like consulting software, office equipment, and client meeting costs. Thankfully, being self-employed allows you to claim tax deductions to save more money when filing taxes. We've found some tax write-offs for consultants that you can claim. Check them out below!

General Expenses

Let us help you.

Working From Home

With remote work becoming more popular, it’s common to work from home as you’ll be advertising your business online, using your consulting software, or virtually meeting with clients. If you have a dedicated office space for business, here are some tax deductions you can claim.

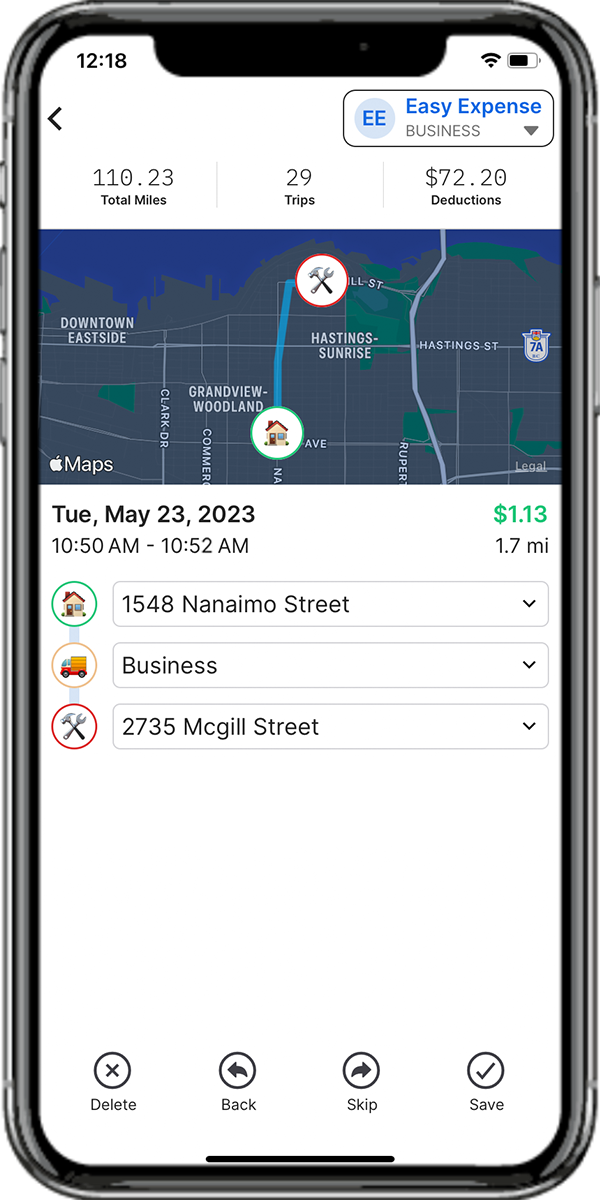

Driving For Work

Being a consultant doesn’t always mean virtual work. Sometimes you’ll have meetings with clients in a physical location to discuss business or potential work. As you’re using your vehicle for business, track these car expenses!

Traveling For Work

Meeting with others for lunch to discuss business? it’s considered a business meal and is generally tax deductible. However, there are some situations where you’ll travel far away for business where staying overnight in a hotel is required. For example, your client requests in-person consultation or you’re going to a workshop for consultants. Thankfully, there are travel deductions you can claim when doing so.