25 Tax Write-Offs for Babysitters in 2023

If you’re a freelance or self-employed babysitter, chances are you won’t receive a 1099-MISC or W-2 form. This means you’ll need to be aware of your self-employed babysitter taxes. Unless you’re considered a household employee, you’ll generally pay the full portion of social security and Medicare taxes (a.k.a. FICA).

However, being self-employed lets you claim certain tax write-offs to reduce your tax burden. Thankfully, we’ve compiled some tax write-offs for babysitters below so you can claim more deductions and pay less taxes!

General Expenses

Let us help you.

Working From Home

When you’re not babysitting, you’ll likely be at home advertising your business online, searching for your next gig, or making schedules. If you have a dedicated space for business (a small desk is fine), here are some home office expenses you can write off.

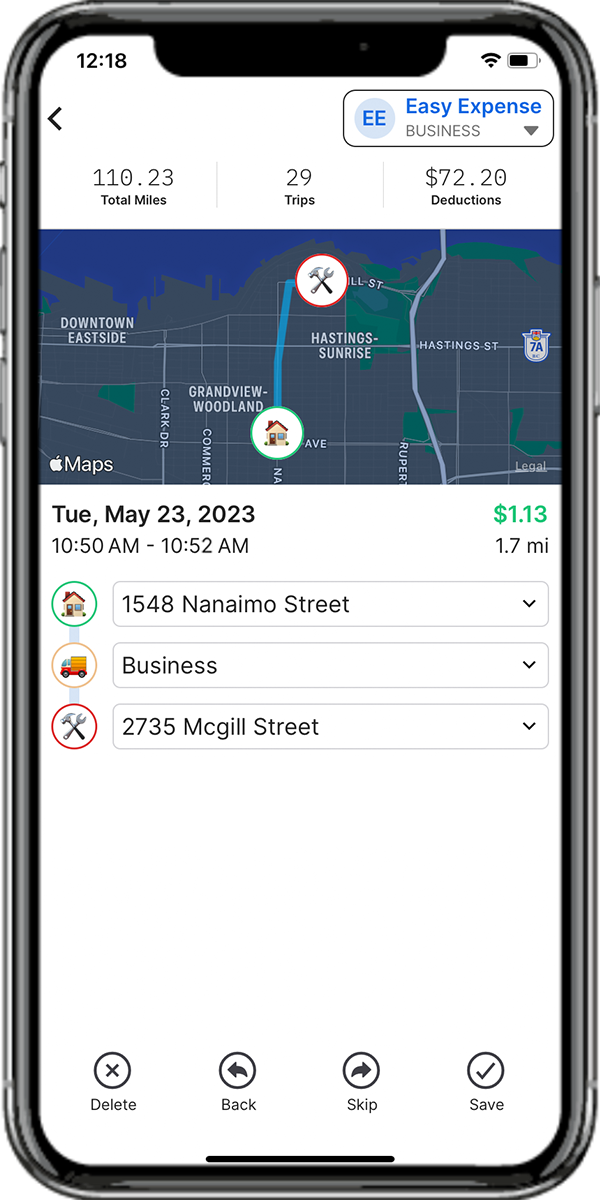

Driving For Work

As a babysitter, you’ll often be driving to a work location, sometimes consecutively. Driving for work or business purposes means mileage deductions. To figure out whether you should use the standard mileage deduction or the car expense deduction, track the following expenses!

Traveling For Work

If you’re temporarily traveling out of state for work or business purposes (like developing your babysitting skills), you can deduct business travel expenses like hotels and transportation.