Best QuickBooks Alternative for Mobile Expense Tracking: Easy Expense

When it comes to the best expense tracker apps, QuickBooks is one of the many apps for tracking business expenses. However, with a high subscription cost and a complex user interface, QuickBooks can be overwhelming for new start ups, small businesses, or independent contractors. As one of QuickBooks' competitors, Easy Expense is the best free QuickBooks alternative for anyone looking for an easy-to-use expense tracker!

What is Easy Expense?

As a similar software to QuickBooks, Easy Expense features expense and mileage tracking, automated bookkeeping, an AI receipt scanner, and detailed expense reports. Focusing on mobile development, their user-friendly interface makes tracking personal and business expenses a breeze. Then when it comes to filing taxes, export your data and easily fill out your Schedule C tax forms!

Pricing

Easy Expense is free to use if you need to scan receipts, track mileage, or link a single bank account. Their free plan includes unlimited receipt scanning, expense and mileage tracking, one bank link, one business, and no teams. Premium features like teams or adding multiple businesses (workspaces) will require a subscription ranging from $48 to $144 per year.

As QuickBooks subscriptions can cost hundreds of dollars every year, Easy Expense is clearly the better option with flat pricing for users and has a free plan.

Pros

- Simplifies bookkeeping and maximizes your tax deductions to save time and money

- Get $14,277 on average in tax deductions

- User-friendly interface makes mobile expense tracking a breeze

- Auto scans your bank accounts for expenses and tax write-offs

- Generate or create custom reports for easy tax filing and reimbursements

- Available on iOS, Android, and Web

Cons

- Web app is still in development so you can't add expenses from your desktop yet

- No income tracking yet

- No odometer tracking

What users say about Easy Expense

Features

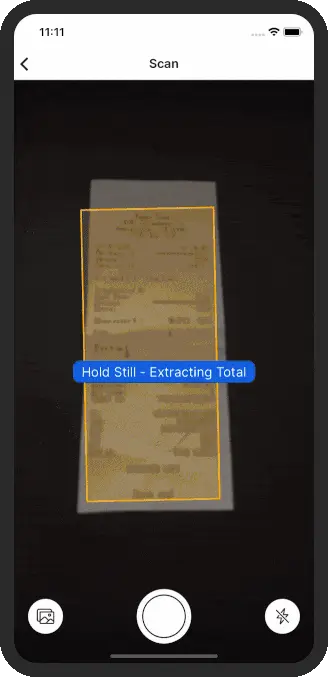

Powerful AI Receipt Scanner

To save you time, Easy Expense's receipt scanner automatically scans, crops, and categorizes your receipts into tax-deductible categories. The receipt scanner will extract the total, tax, vendor, category, and payment method. If there are any errors, you can tap any field on the receipt preview to quickly edit it. You also won't have to wait as extraction happens almost instantly. Other receipt scanners make you wait minutes.

Automatically Track Expenses with Linked Bank Accounts

If you swipe your credit card often, Easy Expense supports linking with over 12,000 banks from US and Canada. To reduce data entry, link your financial accounts to auto scan for expenses and tax write-offs. With auto categorization, you can rest easy with maximized tax deductions.

Track Expenses as a Team

Tracking expenses as a team has never been easier with user level access. Your team can track expenses in a single workspace or create one for each member for individual tracking. Managers and admins can also create shared custom reports for members to add to.

Add Multiple Businesses or Separate Expense Types

Manage multiple businesses or different types of expenses with Easy Expense's unlimited workspaces. As each workspace is unique in terms of data and members, you can create multiple workspace for each business or expense type. For example, to separate business and personal expenses, you can create a workspace for each one.

Automatic and Manual GPS Mileage Tracking

Say goodbye to your paper mileage logs with Easy Expense's mileage tracker. It includes auto GPS tracking that logs trips for you as you drive from point to point. If auto tracking isn't for you, there's always manual tracking. Simply enter a start and end location and they'll do the rest, including mileage deduction calculations.

Simple and Detailed Expense Reports

When it comes to filing taxes or expense reimbursements, you can export your data or create a custom expense report. Easy Expense has multiple report formats and options to ensure you have a report that fits your needs. Unlike QuickBooks, you can share and export your reports from the app.

Conclusion

Consider Easy Expense as a QuickBooks alternative if you need an affordable expense tracker app that simplifies your bookkeeping and maximizes your tax deductions.