Never lose

another receipt

Get peace of mind. Just one lost receipt could cost you hundreds in lost tax deductions or missed reimbursements.

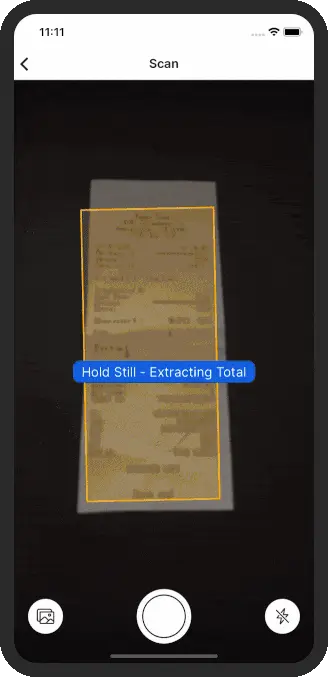

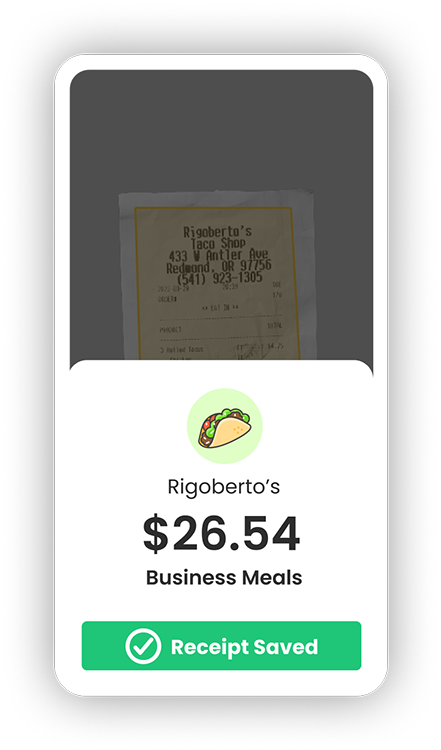

Receipt tracking made magical

Easy Expense has already found over $500 million in tax deductions and reimbursements.

Stay compliant & audit-ready

Turn your receipts into tax savings

- AI automatically labels the tax category, vendor, total, tax, date and payment method

- Smart capture automatically crops receipts

- Protect your data with automatic cloud backups

Organize your digital receipts

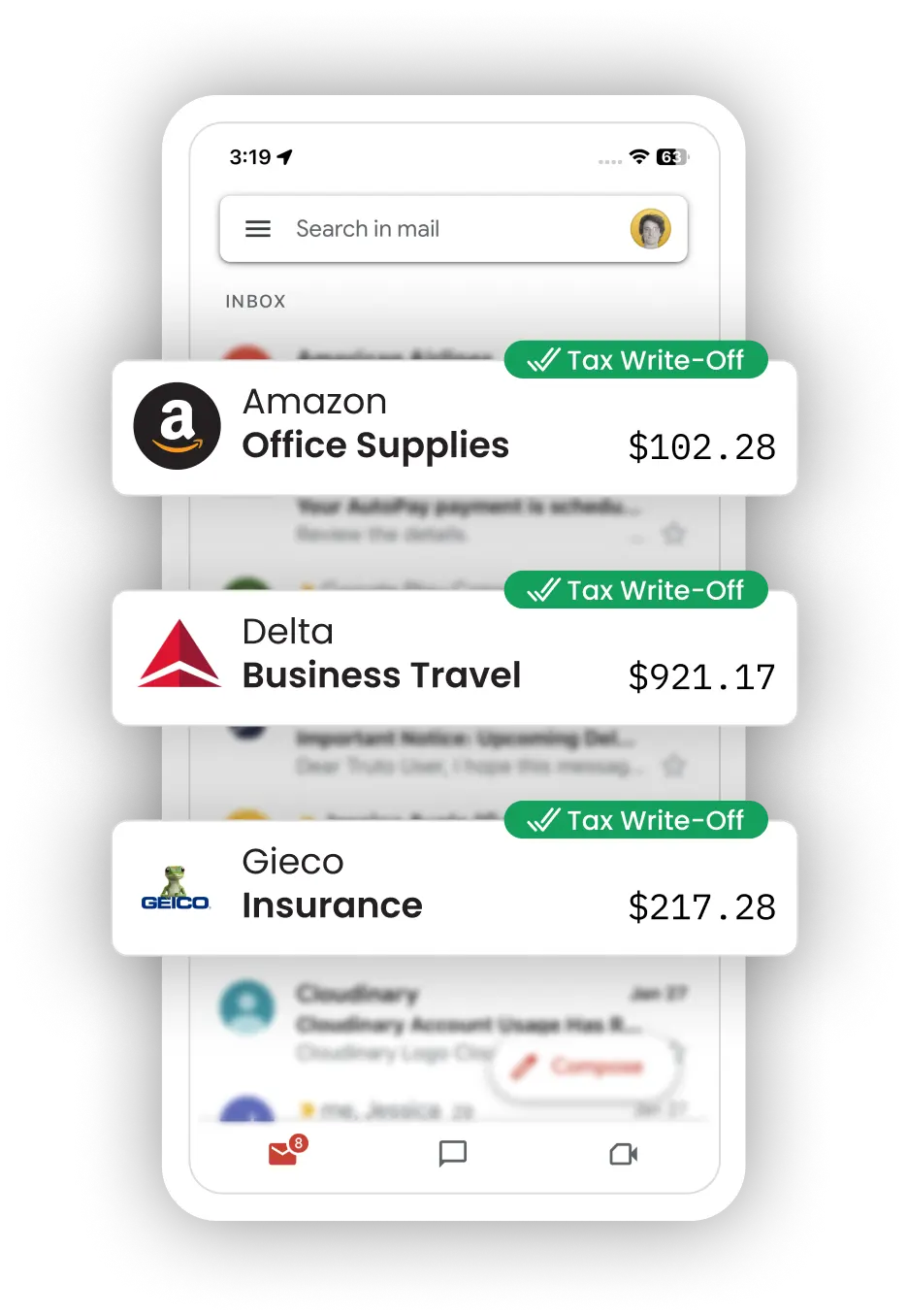

Automatically import email receipts

- Connect your Gmail account to auto scan for receipts

- Forward receipts to upload@easy-expense.com to automatically add them to your account

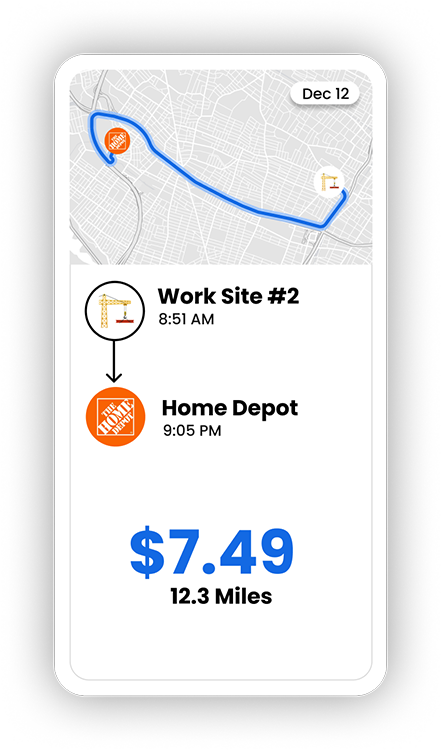

Automatic mileage tracker

Write off $0.67 per mile you drive

- Automatically track drives with GPS

- Save and classify trips in seconds

- Set custom mileage deduction rates

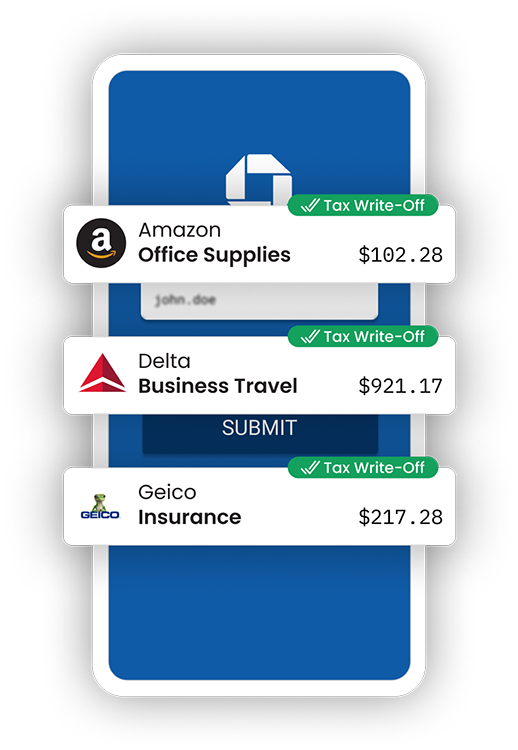

Never miss a deduction

Connect your accounts and find deductions

- Link your bank accounts, credit cards, or emails

- AI scans transactions and classifies tax deductions

- Save an average of $2,192 per year on taxes

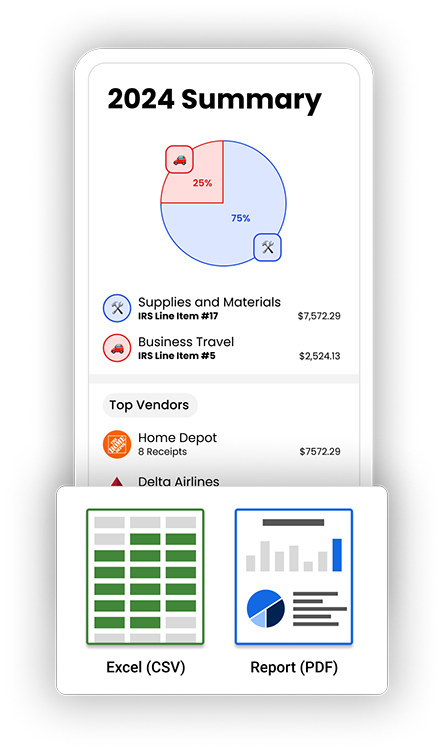

Professional PDF and Excel reports

Download reports at the tap of a button

- Summary reports that make filing taxes easy

- Create PDF expense reports for reimbursement

- Export your data to CSV or Excel

IT'S FAST AND SIMPLE

Our reviews speak for themselves

Very good app for scanning receipts. It automatically identifies the important details from the receipts like name, date, amount, etc

Amandeep B.

Nov 22, 2023

Nov 22, 2023

My schedule has not alottime much time to use this app, but it seems to be exactly what I am looking for and fits my needs, and then some. Loaded with valuable features abilities, and all at a more than reasonable requested rate.

Tony E.

Nov 29, 2023

Nov 29, 2023

I use this app for monthly household budgeting and it works great. The UI is simple and tells me how much is spent at each store or in each category.

Tiffany P.

Oct 6, 2023

Oct 6, 2023

This app helps me tremendously! I can quickly take pictures of all the messy records and easily get the info in a spreadsheet.

Cori M.

Dec 14, 2023

Dec 14, 2023

I recommend Easy Expense to anyone I know from Business Operations professionals, to independent contractors like myself, and even moms! This app helps me to get and stay organized and really is easy to use and understand right away.

Racquel

Aug 17, 2023

Aug 17, 2023

Absolute life saver! I was tasked by my father to calculate taxes from receipts while I have absolutely no knowledge how to do so but this app allowed me to work on them intuitively.

Shine P.

Oct 6, 2023

Oct 6, 2023

This is the first expense app that I've been able to pull a full report out of. I can get the images and a PDF as well as an Excel output from easy receipt scanner. As an accountant, being able to get the XL or CSV output is an absolute requirement.

Uncle T.

Jul 17, 2023

Jul 17, 2023

Great app, we used it more than a month and it's very easy to follow up on income and spending. Scanner works perfectly. Highly recommended

Iliyana Y.

Oct 24, 2023

Oct 24, 2023

Very good app for scanning receipts. It automatically identifies the important details from the receipts like name, date, amount, etc

Amandeep B.

Nov 22, 2023

Nov 22, 2023

My schedule has not alottime much time to use this app, but it seems to be exactly what I am looking for and fits my needs, and then some. Loaded with valuable features abilities, and all at a more than reasonable requested rate.

Tony E.

Nov 29, 2023

Nov 29, 2023

I use this app for monthly household budgeting and it works great. The UI is simple and tells me how much is spent at each store or in each category.

Tiffany P.

Oct 6, 2023

Oct 6, 2023

This app helps me tremendously! I can quickly take pictures of all the messy records and easily get the info in a spreadsheet.

Cori M.

Dec 14, 2023

Dec 14, 2023

I recommend Easy Expense to anyone I know from Business Operations professionals, to independent contractors like myself, and even moms! This app helps me to get and stay organized and really is easy to use and understand right away.

Racquel

Aug 17, 2023

Aug 17, 2023

Absolute life saver! I was tasked by my father to calculate taxes from receipts while I have absolutely no knowledge how to do so but this app allowed me to work on them intuitively.

Shine P.

Oct 6, 2023

Oct 6, 2023

This is the first expense app that I've been able to pull a full report out of. I can get the images and a PDF as well as an Excel output from easy receipt scanner. As an accountant, being able to get the XL or CSV output is an absolute requirement.

Uncle T.

Jul 17, 2023

Jul 17, 2023

Great app, we used it more than a month and it's very easy to follow up on income and spending. Scanner works perfectly. Highly recommended

Iliyana Y.

Oct 24, 2023

Oct 24, 2023

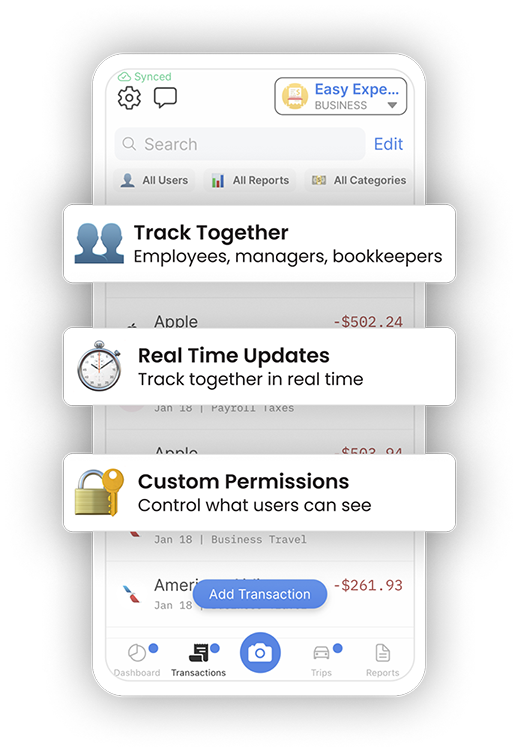

Easy Expense for Teams

Never chase your employees for another lost receipt again.

Learn More

Easy Onboarding. Invite users in just a few clicks.

Simple Billing. Guaranteed long-term pricing for your business.

Expert help. Live in-app chat for your team and one-on-one phone support.

Oct 18, 2023

Dec 14, 2023

Aug 30, 2023

Nov 17, 2023

Aug 29, 2023

Aug 21, 2023

Dec 17, 2023

Dec 20, 2023